|

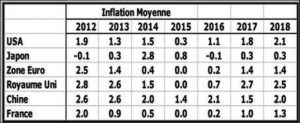

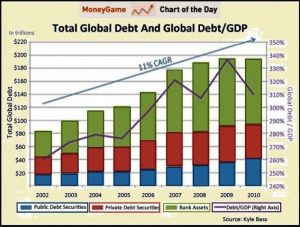

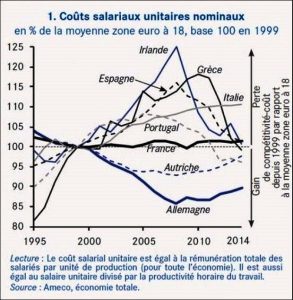

Bibeau.robert@videotron.ca Éditeur. http://www.les7duquebec.com 14.2.2018 THE ARTICLE IS AVAILABLE ON THE WEBMAGAZINE: More money in circulation and yet less inflation? A curious phenomenon, very little analyzed in the “economic” or “generalist” press, which we prefer called the mainstream press “people, format and governance-management”, remains unexplained while two contradictory economic factors coexist: a massive injection of liquidity (money) in the economy and a controlled inflation, which remains at low levels and does not increase over the period 2008 to 2018. (1) What is the inflation? Inflation is manifested by the rise in the price of goods which have not yet increased their “value”, only the prices are rising (2). The inflation indicates a decline in the value of goods (including labor force) and the instrument of exchange, the money Clearly, the inflation is the devaluation of money (money) which leads to the depreciation of wages (income) and the decrease in the purchasing power of individuals. It is often observed that the go-left is on the lookout for reductions in social benefits and government allowances, while remaining steadfast in the face of rising inflation which further erodes the purchasing power and living conditions of the poor salaried workers. There is an unsolicited admission. But, we will be told, the inflation is curbed, barely 2% per year on average. Looking at the average inflation rates in five currency zones (dollar, yen, euro, pound sterling and yuan), we are surprised at the low rate of inflation (Figure 1). Japan, having already begun its phase of economic depression, is even registering negative rates, a fall in consumer prices, which will soon be the lot of all capitalist and socialist economies, if any remain. Figure 1 However, since 2012 the central banks of the countries or group of countries in this sample have not been deprived of printing money and issuing astronomical amounts of fiat money (3). But, as Laurent Herblay write: “If the total monetary base available in the economy is inflated ex nihilo, each monetary unit represents a lower value, as the value of the goods is broken down into a larger number of coupons – of euros, dollars, etc. (4). Quantitative Easing, do you want money here? Despite very low interest rates and massive injections of liquidity, the price and wage indexes are progressing more or less. Since 2008, in order to counter the deflationary pressures on the economy, the central banks have acted both on the price of the currency (low interest rates and even negative) and on its volume, thanks to their policies of “Quantitative Easing”, and the subsequent issuance of liquidity by private banks via consumer credit (to households and students), the corporate credit and the government credit (debt sovereign) as shown in Figure 2 (5). Figure 2 The estimated amount of money in circulation in the world is over US $ 200 trillion (6), and this quantum is skyrocketing every year, which should normally translate into runaway inflation. Yet no, the inflation remains low, the wages hardly increase while the household debt is catastrophic, which augurs badly the day before the rise in interest rates demanded by the bankers. It will be remembered that the 2007-2008 banking – market crisis was triggered by a rise in interest rates by the US Fed following several years of excessive indebtedness of individuals, businesses and governments. In 2018 the global financial situation is similar, but worse.In recent weeks the equivalent of four trillion dollars has evaporated on the global stock exchange, proof that this junk capital did not really exist, it was “monkey money”, say the US traders. Incidentally, on Monday, February 5, the Dow Jones index on Wall Street fell by 1500 points (-10%) at the height of a panic wind (7). In our view, this is a warning that the swindlers have been used by Western central bank managers and rogue politicians to stop procrastinating and start raising the rent on the money. Thus, the same evening, the financial mercenaries and the literary hacks in the pay, in megaphone of the media of “governance-management”, barked with satiety that it would not be two rises of the interest rates which one would have to anticipate but four successive increases this year, hammering the message of their bosses to the officials of capital. Which means that in the West it is millions of people in debt who will be bankrupt in 2018 and thrown on the streets. Not to mention that the states will see their deficits exploded and their sovereign debt soar, resulting in further tax increases. Forgotten, however, the closure of illicit tax shelters for the rich, these are acquired rights of multinational capital. What’s happening on the stock market? What happens on the stock market? Could a law of capitalist political economy have been transgressed without a mechanical reaction on the part of the system? Marx would have been wrong? Not at all. Invisible in the consumer price indices, the inflation is very clearly present in the price of certain financial (stock-exchange) as a result of the expansion of credit. QE (Quantitative Easing) consists of massive programs of securities buybacks. The financial markets have experienced and are experiencing a considerable increase, not directly related to the results of the companies concerned (8). In this way, the shares of some companies are bought back at 10 times the value of anticipated profits. The gain for the speculator lies not so much in the expected dividends of the company as in the speculative outbidding that will allow him to resell these even more expensive shares to the following speculators, it is the mechanism of operation of the financial pyramid Madoff, well known in financial and administrative circles and still ongoing. (9) All this has been made possible by the overexploitation of the workforce of employees. Here’s how Laurent Herblay describes this process: “The revival of activity by credit, especially that made to companies, has not been passed on to individuals in the form of a wage increase, particularly since 2008. Not only the nominal value of wages stagnated or even fallen sharply, but the conditions of job insecurity has increased: the proliferation of fixed-term contracts, precarious jobs and “micro-jobs”, particularly in Germany, has contributed to a slackening of wage growth, as shown in Figure 3. (10) Figure 3 Wage devaluation, precarious and poorly paid jobs, and retention of the monetary creation of the monetary base (M0), these are the three “mechanical” explanations of the apparent lack of impact of the activities of “Quantitative Easing” on inflation. We must not believe that bankers, financiers, investors, stockbrokers and their politicians are scammers, malicious villains who plot in the back of the workers to hurt them arbitrarily. All these people have the mission to manage the portfolios of actions and to increase the collective heritage, it is the mission that entrusted to them the capitalist mode of production. It turns out that this mode of production operates according to imperative laws that no one can transgress without being discarded as an obsolete economic vector. This is so true that following the crisis of 2008, many capitalists and their political sycophants who became aware of the dysfunctions of the capitalist economic model and who tried to “reform” it, including the go-left, unsuccessfully however as proves it this report of the French Senate where it is written: “In fact, since the crisis of 2008, no problem has been solved, after ten years of crisis the probability of reissuing a crash of the financial system of equivalent magnitude has not decreased, quite the contrary. […] All the ingredients, old and new, of a new crash are there” (p.224). The few measures to make the system less unstable, which may have been imposed on him under the influence of emotion and the pressure of public opinion, have not only left the essential untouched, but have been largely compensated by the negative effects of the treatment used to get him out of the coma and revive the economy: the massive injection of cash and interest rates at the limits of the thinkable.»(11). The capital exchange The unstoppable laws of capitalist political economy are applied and can not be circumvented or reformed, though bankers, financiers, administrators, paid politicians and the subsidized go-left think. The function of capital – at the base of the system – is to value oneself – to produce surplus value in order to increase one’s ability to swallow overwork – the unpaid portion of the workday. If, for any reason, the capital no longer succeeds in completing its normal cycle of expanded reproduction, then, like water in the river, the capital will seek another way of passage, without realizing that this alternative path is actually a stalemate. Create “value”, wealth by market capitalization without producing goods for markets does not obviously guarantee the production of value, necessary work and overlabor, salaries and capital gain where from arises the profit. Find where is hiding the inflation There is no miracle, the money creation generates an increase in prices (inflation), it is still necessary to know which ones. As the article in Les Echos notes, the first easily observable inflation is that of financial assets (12). In turn, this rise in financial assets also ignites the real estate prices (13). As real estate costs are rising sharply, it is usually the wealthy who have large portfolios of assets that invest in real estate. The expansion of the money supply has indeed “trickled”on a part of the privileged. The wealthiest class has further widened the gap by having access to an additional manna of credit for goods that only it can afford. As we specify in a previous article “Money calls money and clumps naturally” and the anti-globalists and other varieties of leftists can not change anything, they would have accumulated a billion signatures at the bottom of their phoney petitions. (14) Briefly, the stock market acts here like a black hole which sucks up all cash while the production – a single source of wealth creation – stagnates and income contracts at the base of the social pyramid while the virtual (fictional) wealth explodes at the top of the pyramid where are concentrated the volatile speculative stock value (until the crash). Thus, the fictitious stock exchange values, not backed by goods, means of production, marketing or communication – require new credits that the political authority will have to requisition in the pockets of individuals, businesses, traders, in the pockets of those who work and produce value, especially surplus value – this value not paid to workers – to feed the stock market and banking beast. It is impossible to reform or “to reformat” this system (mode of production), the proletariat has to bring down it and build a new mode of modern production. Natixis would have converted! Let us pay tribute to the Natixis Bank of Paris for having recognized the merits of the Marxist analysis of the capitalist mode of production in these terms: “Marx was right, the decline of the efficiency of the companies (slowdown of the Global Productivity of the Factors), other things being equal, would imply a decline in the return on capital of firms. The businesses respond to this development by reducing wages (by distorting the revenue sharing for profit). But this strategy has a limit, reached when the low wages become too low (equal to the wage of subsistence) and the “capitalists” then launch in speculative activities which make appear financial crises» (15). |

NOTES

- Laurent Herblay on: https://www.agoravox.fr/actualites/economie/article/la-mondialisation-heureuse-contre-201198and https://www.agoravox.fr/actualites/economie/article/la-mondialisation- happy-against-201197

- The market value of a commodity is equivalent to the amount of work required for its production and marketing. Value is therefore a relation between working time and the value of the labor force (wages and benefits). The rate of inflation is defined here:

http://www.linternaute.com/dictionnaire/fr/definition/taux-d-inflation/ “Loss rate of the purchasing power of the currency is characterized by a general increase and constant price”.

- https://fr.wikipedia.org/wiki/Monnaie_fiduciaire

- Laurent Herblay: https://www.agoravox.fr/actualites/economie/article/la-mondialisation-heureuse-contre-201197

- “QE (Quantitative Easing) is a radical and simple way to massively expand the available liquidity in the economy. A central bank decides to create money, not by issuing notes and coins, but by creating a simple line of credit. The financial world has long gone from a fiat currency to a scriptural currency. From this credit decided ex nihilo by a writing game, she bought a number of financial assets from private investment banks, stocks, bonds or derivatives. These massive purchases are giving private banks fresh new liquidity, allowing them to extend more loans to individuals under low interest rates. Ultimately, this flow of credits is supposed to boost the consumption and blow on economic activity”.

Source: https://www.agoravox.fr/actualites/economie/article/la-mondialisation-heureuse-contre-201235 What ultimately leads to the fact that each monetary unit (yuan, dollar, yen, euro or ruble) that a bank kept in reserve represented, in 2013, 370 times its value in circulation.

https://fr.wikipedia.org/wiki/Monnaie_fiduciaire

- Whether in the form of aggregates M0, M1, M2, M3, or M4 as defined here:

https://fr.wikipedia.org/wiki/Masse_monétaire Other data here:

- “A panic grabbed Wall Street on Monday, where the New York City’s flagship index fell drastically after several months of market euphoria regularly welcomed by President Donald Trump».

Http://www.lapresse.ca/business/marches/201802/05/01-5152623-the-dow-jones-perd-more-1100-points.php

- Also known as the “Central Bank Currency”, the Monetary Baserefers to both the notes and coins in circulation and the monetaryassets held by the banks with the Central Bank. This monetary base is of paramount importance in the process of monetary

https://www.agoravox.fr/actualites/economie/article/la-mondialisation-heureuse-contre-201198

- http://www.senat.fr/rap/r16-393/r16-3931.pdf

- https://www.lesechos.fr/idees-debats/cercle/cercle-173178-non-linflation-na-pas-disparu-elle-sest-deplacee-2110020.php

- In Canada “The housing bubble is primarily based in the Greater Vancouver and Greater Toronto Area and surrounding cities. Housing prices in Vancouver increased by 27 per cent from February 2015 to February 2016, reaching an average of $ 1.3 million for a single-detached home. The average price of a single-family house even went up to $ 1.7 million in July 2016. For its part, housing prices in the overheated housing market in the City of Toronto increased by 33% between March 2016 and March 2017, the average price of a single-family home reaching $ 1.6 million. The price of a home in the Greater Toronto Area averaged $ 916,567 in March 2017, compared to $ 688,011 a year ago. “http://www.les7duquebec.com/7-dailleurs-2-2/la-situation-economique-et-politique-au-canada-en-2017/

- Robert Bibeau. October 2017. http://www.les7duquebec.com/actualites-des-7/la-richesse-continue-de-se-concentrer-au-sommet/

- https://www.agoravox.fr/tribune-libre/article/les-predictions-de-karl-marx-201269

Traduction by Claudio Buttinelli. Roma

UPDATE OF THE PROLETARIAN POLICY ON THE NATIONAL ISSUE

| NATIONAL ISSUE AND PROLETARIAN REVOLUTION UNDER MODERN IMPERIALISM |

| Robert Bibeau

ENGLISH BOOK FREE (HERE) http://www.les7duquebec.com/wp-content/uploads/2017/05/bon-NATIONAL-QUESTION-AND-PROLETARIAN-REVOLUTION-UNDER-THE-MODERN-IMPERIALISM-revision.docx ET ITALIAN BOOK (ICI) http://www.les7duquebec.com/wp-content/uploads/2017/05/bon-QUESTIONE-NAZIONALE-E-RIVOLUZIONE-PROLETARIA-SOTTO-LIMPERIALISMO-MODERNO-revisione.docx GRATUITEMENT EN TÉLÉCHARGEMENT. |

Éditeur du webmagazine http://www.les7duquebec.com